Over half of Illinois’s private sector workforce – roughly 2.5 million people and 1.7 million in the Chicago region alone – lack access to an employment-based retirement plan. Those Illinois citizens lucky enough to be automatically enrolled in a retirement plan through work are more likely to enjoy a secure and dignified retirement than their uncovered counterparts.

The Illinois Secure Choice Retirement Savings Program (“Secure Choice”), signed into law last year, will begin to make automatic retirement savings a reality for these uncovered workers, bringing much-needed retirement readiness to as many as 1.2 million Illinoisans. The new program will give covered employees (those who work in firms with at least 25 employees andt have been in business for at least two years) access to an employer-based, portable, individual retirement savings account, with automatic deductions from their paychecks.

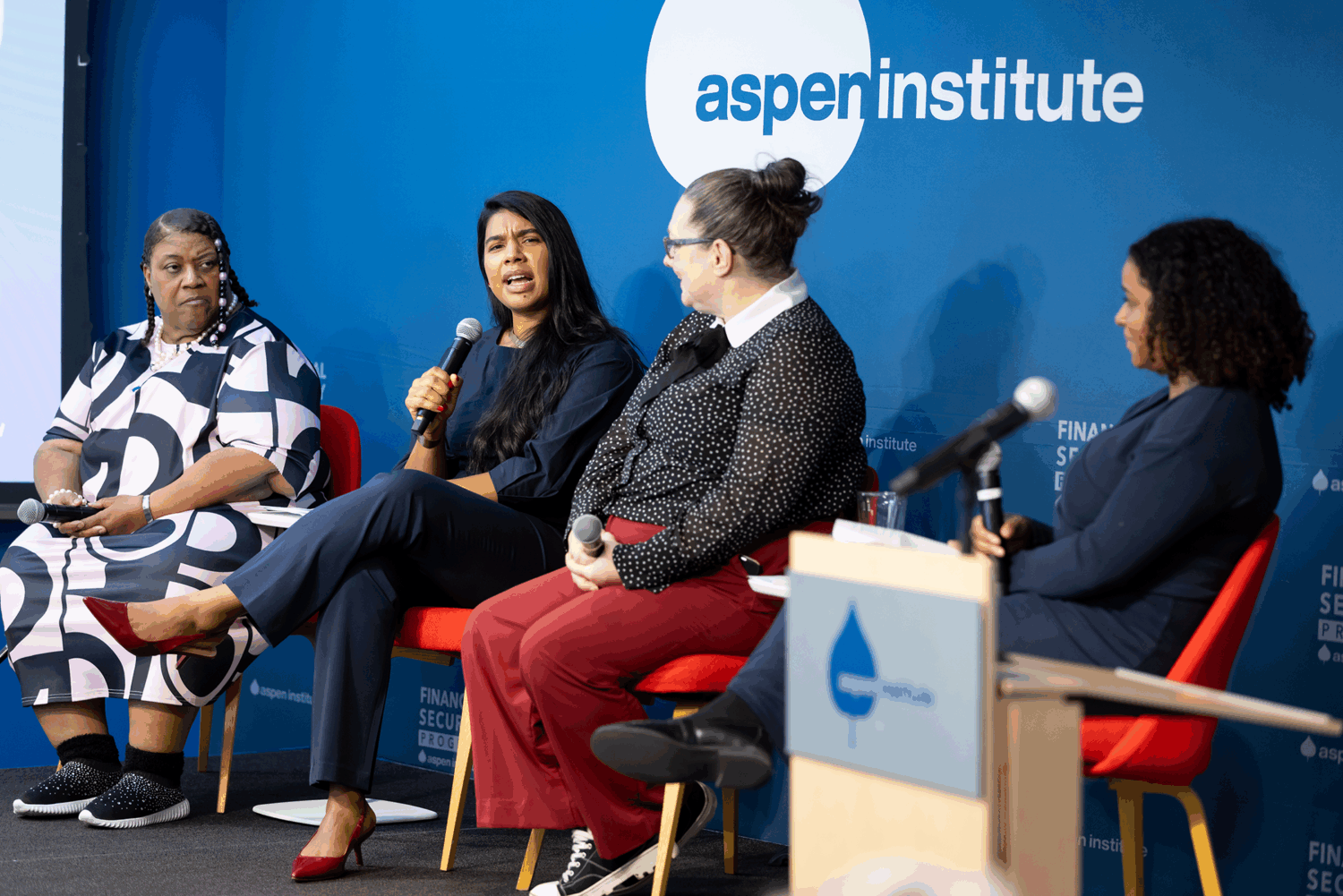

The Aspen Institute’s Financial Security Program (FSP) will convene an event in conjunction with the Secure Choice Board to explore issues on the design and implementation of the program that will be critical to a successful roll-out.

The event will bring together a diverse array of expert opinion from the financial industry, academia, and the advocacy community. We hope to offer valuable input to the deliberations of the Board as they move forward to bring this important new program to fruition.

Featuring Opening Remarks from:

Ida Rademacher

Executive Director, Financial Security Program, The Aspen Institute

The Honorable Daniel Biss

9th Senate District, Illinois State Senate

The Honorable Michael W. Frerichs

Illinois State Treasurer

Followed by Keynote Remarks from

Dr. Richard Thaler

Professor of Behavioral Science and Economics, University of Chicago Booth School of Business

And a Panel Discussion That Will Include

Ida Rademacher

Executive Director, Aspen Institute Financial Security Program

And a Panel Discussion that will Include:

Pete Isberg

Vice President of Government Affairs, ADP

David Madland

Senior Fellow and Senior Advisor, American Worker Project, Center for American Progress

Lucy Mullany

Financial Empowerment Policy Project Lead, Heartland Alliance

Martin Noven

Senior Director, Government Markets, TIAA

Moderated by:

Jeremy Smith

Associate Director, Financial Security Program, The Aspen Institute